Key insights – The Future of Private Equity Investing is all about PAOVA (Post-Acquisition Operational Value Add)

Key insights from the Partners Capital whitepaper on The Future of Private Equity Investing is all about PAOVA

- Post-Acquisition Operational Value Add (PAOVA) is becoming the critical differentiator between alpha-generating and alpha-detracting sponsors

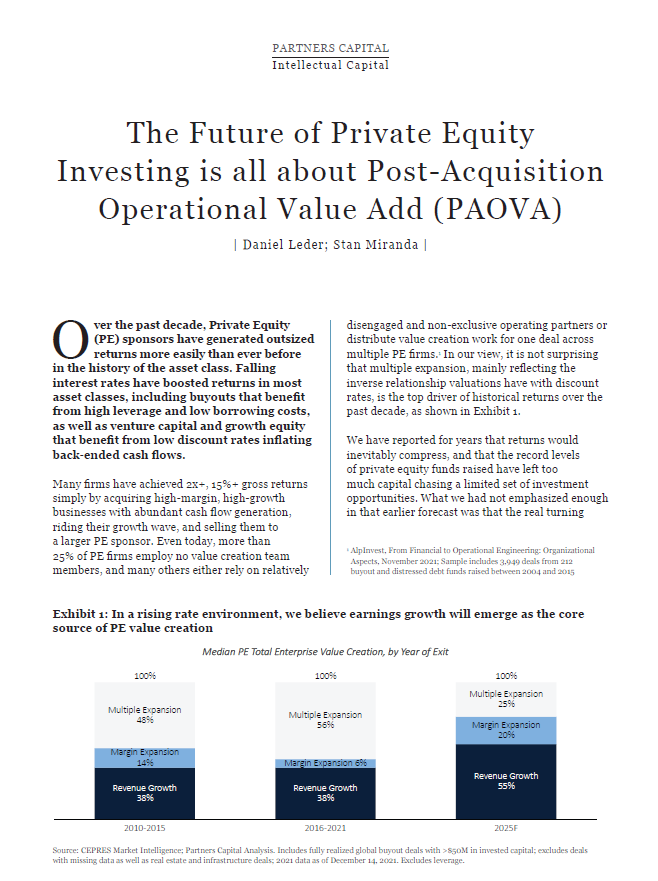

- Past PE returns were boosted largely by falling rates, leverage, and multiple expansion rather than true operational improvements – that era of easy gains is over – going forward, Revenue & EBITDA growth will be the main driver of PE value creation

- Many PE firms still lack dedicated value creation resources, leaving them vulnerable in the new environment

- Limited Partners (LPs) must enhance diligence capabilities to identify sponsors with proven PAOVA skills; simple allocation to growth sectors or geographies will not suffice

- Best practice is shifting toward internal portfolio groups with functional expertise rather than relying solely on deal teams or external advisors

- Funds with strong operating groups show significantly higher returns than deal-team-only models (2.26x vs 1.82x MOIC on average)

- The winning firms of the future will be the ~20% of PE firms that have robust in-house PAOVA capabilities

Source: Partners Group – https://partners-cap.com/insights/the-future-of-private-equity-investing-is-all-about-post-acquisition-operational-value-add-paova/